Defined broadly, crowdfunding is a joint effort by individuals to support a cause, company or organization. These individuals are collectively referred to as the “crowd.”

The role of the individuals in the crowd is to pool their resources. The resource most commonly pooled is money, which is how the word “funding” was added to “crowd” in “crowdfunding.”

The individuals in the crowd recognize that they can accomplish significantly more by working collectively, rather than separately. This recognition is what brings the crowd together and gets them working productively with each other, even if they were strangers beforehand.

The notion of crowdfunding has actually existed for centuries as crowds gathered to hear and support pitches, but digital technology and social media have catapulted that notion to new heights and expanded the playing field and the playbook.

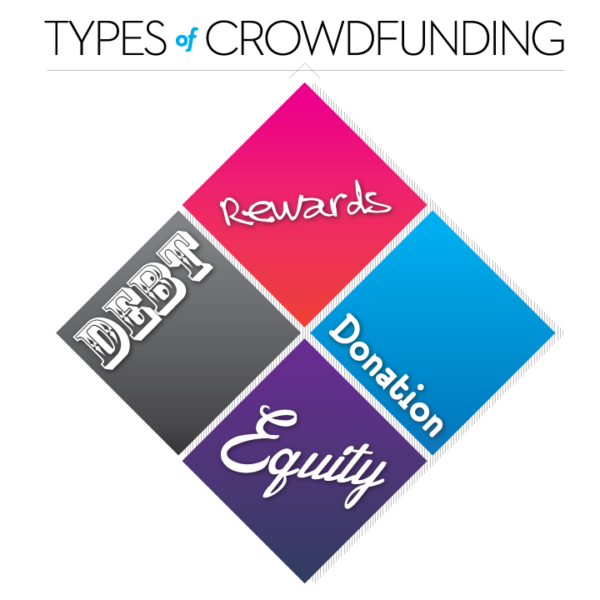

There are basically four different types of crowdfunding – we briefly explain them all in this article. The four types of crowdfunding are:

- DONATION

- REWARD

- EQUITY

- and DEBT

In DONATION-based crowdfunding, the crowd gives money or some other resource because they want to support the cause. One example is a youth soccer team which is raising money to travel to a tournament. The crowd gives money and gets nothing in return, other than the good feeling that comes with knowing the team can travel to compete.

In REWARD-based crowdfunding like Jumpstarter Crowdfunding in South Africa, individuals forming the crowd give money to a business in exchange for a “reward,” typically the product or service that that particular indivdual/company produces or provides.

With EQUITY-based crowdfunding, members of the crowd become part-owners of the company which is raising funds. In other words, the company sells some or all of its shares to the members of the crowd. As equity owners of the company, the crowd realizes a return of its investment and, assuming the company performs well, receives a share of the profits, in the form of a dividend or distribution.

DEBT crowdfunding is the last type. In this type of crowdfunding, the company raising money does not sell shares, but instead borrows money from the crowd. The individuals lending the money receive the company’s legally binding commitment to repay the loan at certain time intervals and at a certain interest rate.

These are the four basic types of crowdfunding.

The more you get involved with crowdfunding, the more you will learn. And the more you learn, the more you will understand the exciting opportunities presented by this new industry!